Individual 401k calculator

An Individual 401k can be one of the best tools for the self-employed to create a secure retirement. Solo 401 k Contribution Calculator Please note that this calculator is only intended for sole proprietors or LLCs taxed as such.

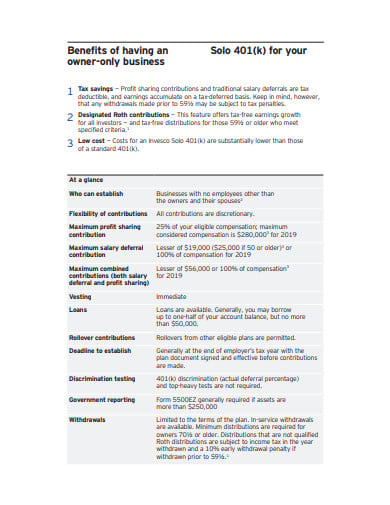

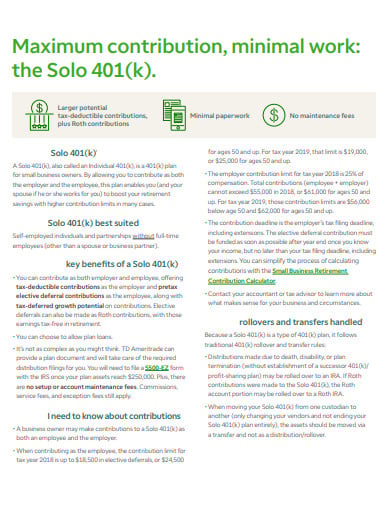

Solo 401k Contribution Limits And Types

Tax Deductible Contributions Individual 401k retirement plans may.

. It provides you with two important. Enter your name age and income and then click Calculate The. With Fidelity you have no account fees and.

First all contributions and earnings to your. Calculator to Estimate Potential Contribution That Can Be Made to Individual 401K Plans. Open a Roth IRA Account.

If youd like to save even more for retirement consider opening an individual retirement account which gives you another 6000 in tax-advantaged contributions or 7000. If your business is an S-corp C-corp or LLC taxed as such. 401k Retirement Calculator Calculate your retirement earnings and more A 401 k can be one of your best tools for creating a secure retirement.

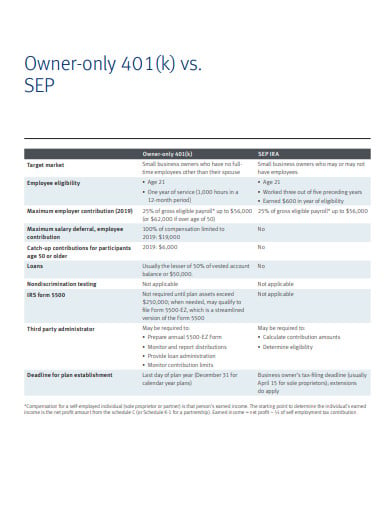

They do count toward. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment. Self-employed individuals owner-only businesses and partnerships can save more for retirement through a 401 k plan designed especially for you.

Ad A One-Stop Option That Fits Your Retirement Timeline. Use the Individual 401 k Contribution Comparison to estimate the potential contribution that can be made to an Individual 401 k compared to Profit Sharing SIMPLE or SEP plan. Free 401k calculator to project how much youll need in retirement.

Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. Ad A One-Stop Option That Fits Your Retirement Timeline. Ad The Sooner You Invest the More Opportunity Your Money Has To Grow.

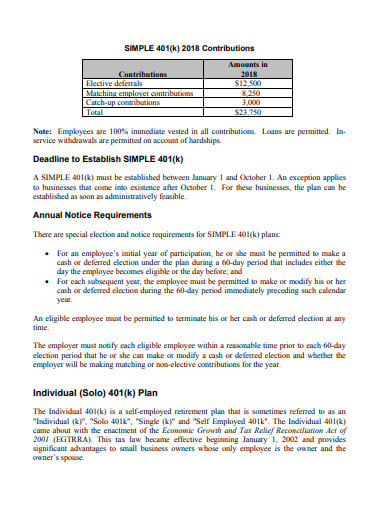

This is the maximum amount you are allowed to contribute to your Individual 401 k account per year. Solo 401k Contribution Calculator. A 401k is a type of account where individuals deposit the amount pre-tax and defer the payment of taxes until withdrawing the same at the time of retirement.

Use the self-employed 401 k calculator to estimate the potential contribution that can be made to an individual 401 k compared to profit-sharing SIMPLE or SEP plans for 2008. A Solo 401 k. In 2020 the maximum contribution to an Individual 401 k is 57000 for individuals under 50 and for individuals age 50 and over there is an additional 6500 catch-up contribution.

Individual 401k Savings Calculator. To determine the annual retirement contribution you could make based on your income use the Individual 401k Calculator. Dont Pay Taxes When You Withdraw Your Money After You Retire.

Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Get a Diversified Portfolio for your Retirement Goalsin One Simple Investment. NerdWallets 401 k retirement calculator estimates what.

Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income. 401k Calculator A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement. See the impact of regular contributions different rates of return and time horizon.

Simply enter your name age and income and click Calculate The result will be a comparison showing the annual retirement contribution that would be permitted based on your income in a. In 2022 the maximum contribution to an Individual 401 k is 61000 for individuals. Get a Diversified Portfolio for your Retirement Goalsin One Simple Investment.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Ad Choose Your Plan and Calculate Between Several Options for Tax-Advantaged Savings.

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Solo 401k Contribution Calculator Solo 401k

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

401k Contribution Calculator Step By Step Guide With Examples

2020 2021 Solo 401k Contributions How To Calculator S Corporation C Corp Llc As S C Corp W 2 Youtube

How Much Can I Contribute To My Self Employed 401k Plan

Solo 401k Contribution Calculator Solo 401k

How Much Can I Contribute To My Self Employed 401k Plan

Free 401k Calculator For Excel Calculate Your 401k Savings

Solo 401k Contribution Limits And Types

Making Year 2022 Annual Solo 401k Contributions Pretax Roth And Voluntary After Tax A K A Mega Backdoor My Solo 401k Financial

Retirement Services 401 K Calculator

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Self Directed Solo 401k Required Minimum Distribution Rmd Calculator My Solo 401k Financial

Self Directed Solo 401 K Archives American Ira

Solo 401k Contribution Limits And Types